Challenge

India’s launch of its Pradhan Mantri Jan Dhan Yojana (PMJDY) program significantly increased account opening by men and women account. However, many of those accounts were not actively being used, especially by women. Bank of Baroda, which manages 14% of the PMJDY accounts, estimates that 31.8 million women customers holding participating in the program. While women Business Correspondents (BCs) in India have the potential to significantly increase women’s use of digital financial services, 90% of BCs remain men. This case is described in Women’s Agent Network—The Missing Link in India’s Financial Inclusion Story, published by MicroSave Consulting.[1]

Approach

With support from Women’s World Banking, Bank of Baroda launched a targeted initiative to create a targeted savings product for women, called Jan Dhan Plus, as well as increase the number of women BCs and enhance the effectiveness of both women and men BCs in engaging women customers from the National program. Key strategies included:

- Capacity building for BCs on relationship-building, cross-selling relevant financial products, and improved customer management.

- Stronger performance monitoring, including MIS dashboards and incentive structures tied to performance.

- Customer segmentation to match specific customer profiles by interest and geography to appropriate BCs.

- Targeted support for women BCs, such as assistance with licensing, access to loans, and additional training to help them enter and remain in the role.

Results

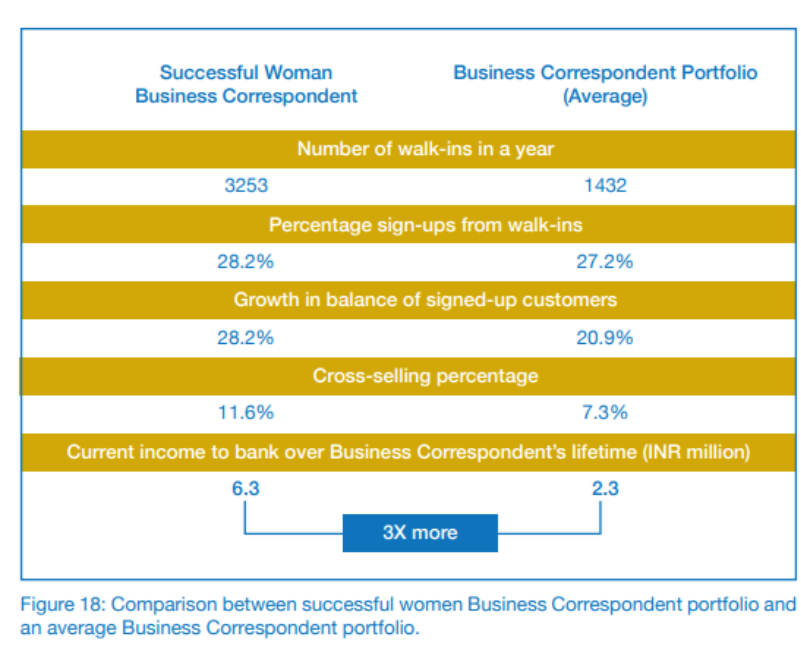

Increasing the number of women BCs led to a rise in customer acquisition and the uptake of additional financial products. Upskilled BCs—particularly women—were preferred by women customers over other channels such as branches, ATMs, or digital interfaces. During the pilot period, 50,000 customers signed up for the Jan Dhan Plus service and 32% of women working with BCs signed up within the first 2 months.

Image Source: The Power of Jan Dhan: Making Finance Work for Women in India, Women’s World Banking[2]

At a national level, a project between India’s National Rural Livelihoods Mission, the World Bank, and several banks in 20 states across India have been working to onboard 100,000 women as BCs.[3] They have focused on recruiting and training BCs from Self-Help Groups (SHGs). This is coupled with the announcement from the Indian Government’s Depart of Financial Services to a) create a target of a minimum of 30% of BCs to be women in each state; and b) an initiative to support the training of men BCs to bolster their customer engagement skills with women. These two efforts are successfully transforming the landscape of women BCs in India.

[1] Akhand Tiwari, Sonal Jaitly and Gayatri Pandey, “Women’s Agent Network—The Missing Link in India’s Financial Inclusion Story,” MicroSave Consulting, February 21, 2022, https://www.microsave.net/2022/02/21/womens-agent-network-the-missing-link-in-indias-financial-inclusion-story-a-supply-side-perspective/.

[2] “The Power of Jan Dhan: Making Finance Work for Women in India,” Women’s World Banking, August 18, 2021, https://www.womensworldbanking.org/wp-content/uploads/2021/08/WWB-The-Power-of-Jan-Dhan-Report-Web.pdf.

[3] Emilio Hernandez, Rebecca Calder, Divya Hariharan, and Cristina Martinez, “Women Agents for Financial Inclusion: Exploring the Benefits, Constraints, and Potential Solutions,” CGAP, October 2023, https://www.cgap.org/sites/default/files/publications/WorkingPaper_Women%20Agents_Final.pdf.