Participating DFSPs should implement notifications that are clear, communicate in varied modes (including audio and iconography), are needed, context appropriate, controllable by users, and where possible, inspire confidence and even joy in the user experience. At a minimum, notifications must serve a functional purpose of keeping a user (whether an individual or a merchant) aware of what is happening in the transaction process. The DFSP must do this in a way that is safe for the end user, considers their privacy needs and preferences, and gives the end user control over notification settings.

Although notifications may introduce friction into the user experience (e.g., in a case where a notification asks a user to assess whether the transaction they are initiating might be fraudulent), the benefits outweigh the friction.

Though implementation of notifications sits primarily with the DFSP, an Inclusive IPS can take an active role in setting minimum requirements for DFSP notifications. Further, inclusive IPSs and DFSPs taking a co-design approach to include the voices of women and other end users will ensure that notifications are optimized for key user segments.

The notifications below are essential. However, DFSPs should ensure that end users are able to control their notifications with simple defaults and on-off toggles. As explored in this section’s Risk Note, this is a critical practice for preserving privacy of users, particularly those who may be transacting on a shared device.

Minimum Notifications

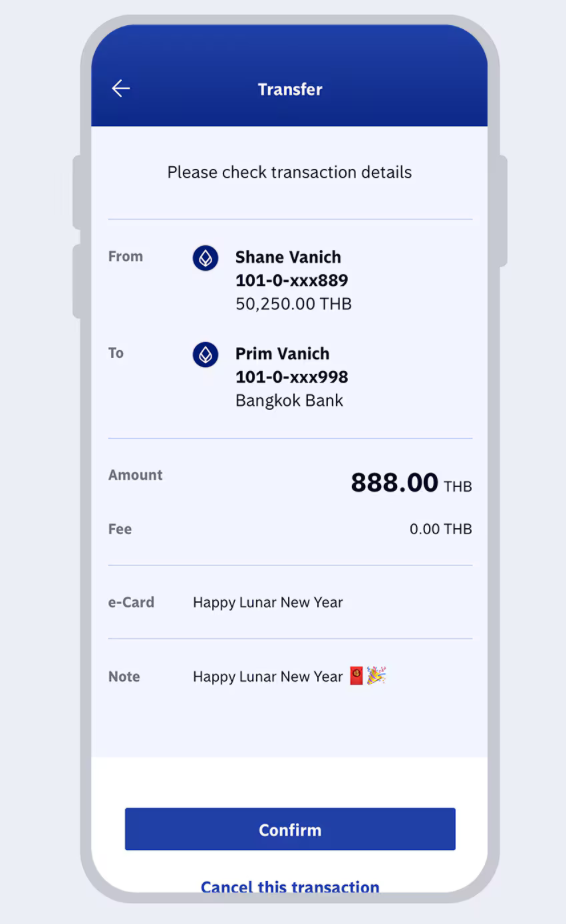

Confirmation of Terms (Amount):

Users should be clearly informed of the terms, in particular the amount of the payment, they are making. All terms must be accepted by the payer prior to execution.

Image source: Bangkok Bank PromptPay documentation

Confirmation of Payee:

Users should be presented with a screen that shows the party to whom they are sending funds that reflects a standardized name selected by a user at account setup and requires confirmation prior to the payment being initiated. See Confirmation of Payee Practice.

Confirmation of Receipt:

Notifications should indicate to both payers and payees that the transaction is completed.

Image source: Pix

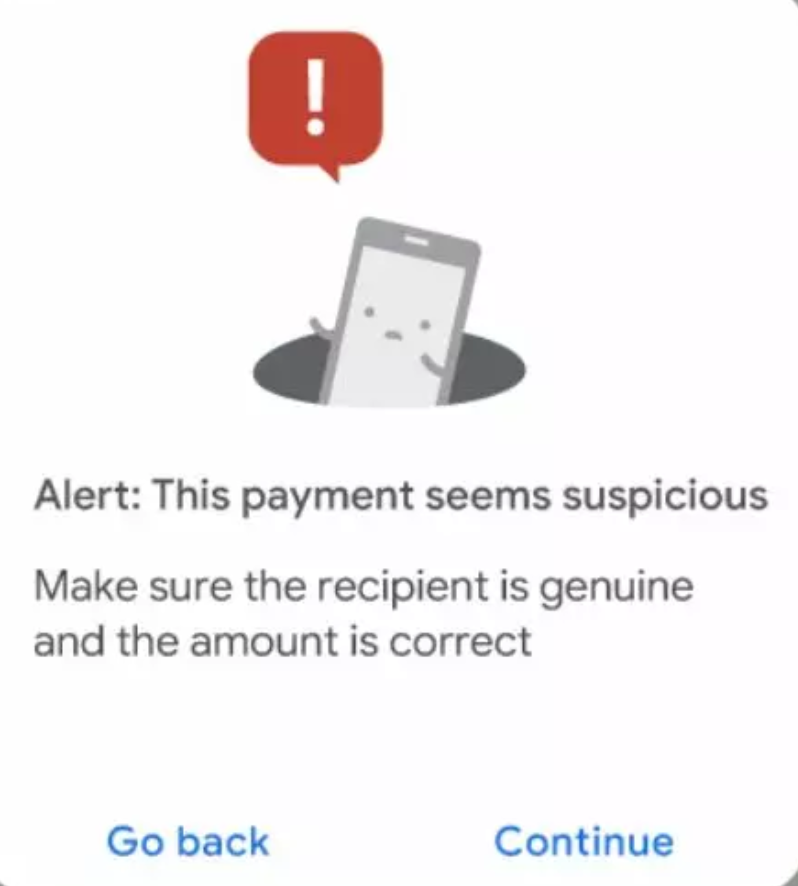

Alert to Suspected Fraudulent Activity:

DFSPs should inform users if they detect potentially fraudulent activity, allowing the user to cancel a transaction or take other precautionary measures.

Image source: Google Pay India

Additional Notification Types

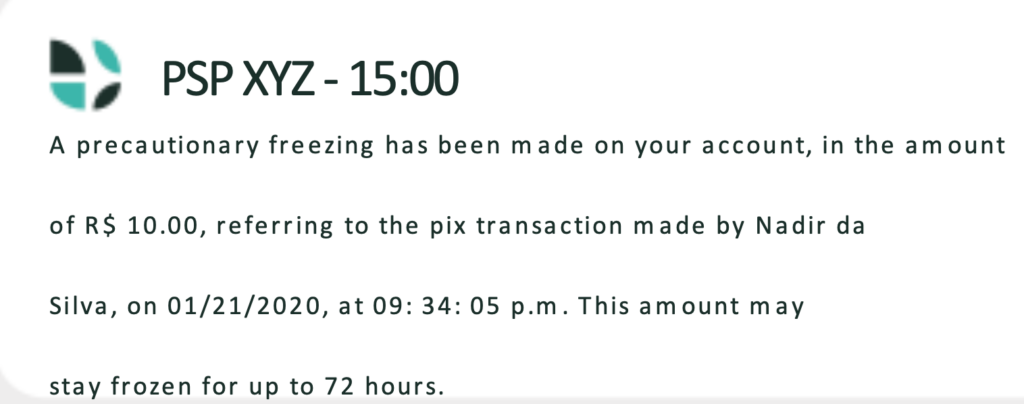

Alert on Delay:

When a technical error or fraud screening procedure interrupts the expected payment process, this should be clearly communicated to the user.

Image source: Pix

Nudges and Push Notifications:

Notifications to users can help improve engagement and incorporate lessons about how to use their account effectively and safely.

Image source: EasyPaisax

Tips for Effective Notifications

- Use varied modes of communication, including text, iconography, and audio to ensure that notification messages are unambiguous—even across a diverse population of users with varying degrees of digital and basic literacy

- Integrate messaging with similar look and feel as your DFSP brand, using IPS brand where it engenders trust or authority (see Common Scheme Branding Practice for additional guidance)

- Offer multi-channel notifications, potentially including in-app alerts, SMS communications, and auditory messages