Ensuring Certainty of Payee starts with the account opening process and alias registration.

- Account name added at KYC process. During transaction account opening, following local KYC requirements, users are assigned an internal account name by their DFSP. Typically, a consumer account name is the first and last name of the account holder while a company account is identified by the registered legal company name.

- Account naming standardization. A good practice by DFSPs will allow the user to select a preferred account name within a set of standard choices (e.g., a nickname or initial for first name) for use within the context of making and receiving payments, clearly explaining the market-specific risks or benefits of using a particular naming convention to end-users. The options for a preferred account name need to be clear and representative of who the customer is while providing sufficient options that consider gender sensitivity and reluctance to reveal gender. Account naming options should consider low literacy concerns faced by some end users. (See the example below).

- End user optionality in account naming: Either at initial account opening or subsequently, the user also registers an alias or set of aliases by which they are discoverable to other users (see Alias Addressing for potential options and guidance on why certain aliases, like phone numbers, may not be appropriate for all women end users). An alias is used to receive payments without the need to share an account number with the sender. Alias registration may provide another opportunity for the user to associate a preferred account name for the account linked to an alias.

- Clarity in identifying receiver. The receiver’s account name will be displayed to the sender before the sender initiates a payment transaction to ensure that the payment is sent to the correct receiver. A clear and relatable name is critical to ensuring that the sender is able to confirm the receiver. Clear account naming is relevant across use cases. For example, for a QR-enabled merchant payment, fraud may be prevented by displaying the merchant account name to the customer before they initiate the payment transaction.

Account Naming Example

Let’s take Amara Genevive, who wants to open a personal transaction account. To protect her privacy, she prefers not to use her full name as the account name that is displayed to sender.

At account opening, Amara Genevive’s account would be assigned her full name in the DFSP’s internal records. However, she would be able to select from a standardized list of alternative name formats that link to her selected alias that would still be relatable to her name but would not allow her to select a name that suggests she is someone else (in case Amara was a fraudster). Potential account names are highlighted below; the specific options would reflect conventions that are common in the local context.

When Amara registered her account online, she selected a random number alias to be associated with her account. The random number alias is a type of alias supported by her DFSP and the Inclusive IPS.

| Name used in account onboarding and KYC process: AMARA GENEVIVE Alias registered by Amara in the system (illustrative): 12345678 Available display names presented by the DFSP to the user (user selects only 1, but can change their choice at any point): | ||

| Syntax | Value displayed to counterparty | Alias associated with account |

| First name/last name | Amara Genevive | 12345678 |

| First initial/last name | A Genevive | 12345678 |

| First name/last initial | Amara G | 12345678 |

If Amara selects A Genevive as her preferred account name, the DFSP would associate her account with both Amara Genevive and A Genevive. Prior to initiating a payment to Amara, a sender would see A Genevive as the account owner assigned to the random number alias 12345678.

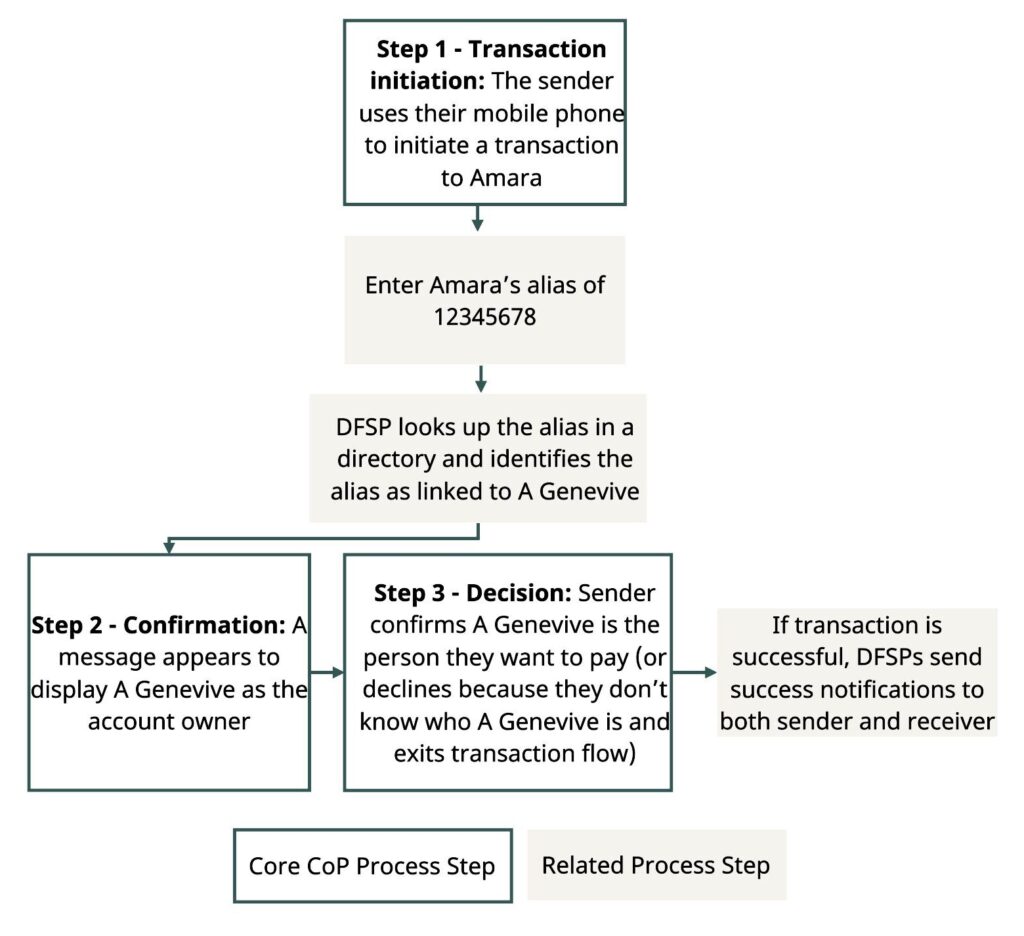

The diagram below shows a simple flow of what good looks like for a sender initiating a payment to Amara. This same process flow applies to payments made to a business.

Embedding Certainty of Payee features adds an extra step into the end user payment journey. However, when well-designed and implemented, the benefit of ensuring that money is sent to the right person builds confidence, not frustration, into the system.

Illustration of Confirmation of Payee Process